Сайт кракен заблокирован krmp.cc

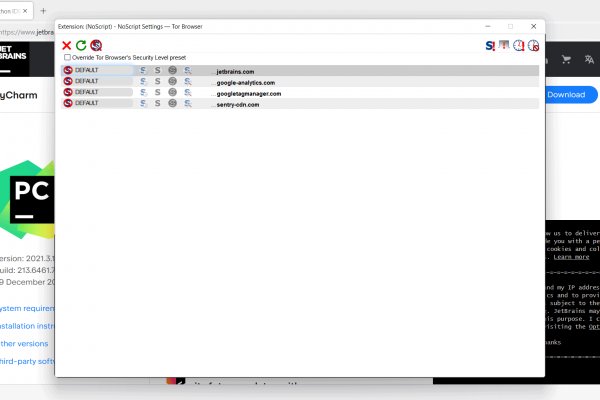

IP адрес сервера: Имя сервера: apache/2.2.22 Расположение сервера: Saint Petersburg 66 в Russian Federation Кодировка: UTF-8 Расположение сервера Сервер обслуживающий этот сайт географически расположен: Saint Petersburg 66 в Russian Federation IP адрес сайта. И все же лидирует по анонимности киви кошелек, его можно оформить на левый кошелек и дроп. Еще один способ оплаты при помощи баланса смартфона. Вас приветствует обновленная и перспективная площадка всея русского даркнета. Всем известный браузер. Таким образом, тёмный мир интернета изолируется от светлого. Wp3whcaptukkyx5i.onion - ProCrd относительно новый и развивающийся кардинг-форум, имеются подключения к клирнету, будьте осторожны oshix7yycnt7psan. Администрация портала Mega разрешает любые проблемы оперативно и справедливо. Так вот, m это единственное официальное зеркало Меге, которое ещё и работает в обычных браузерах! I2p, оче медленно грузится. Пока пополнение картами и другими привычными всеми способами пополнения не работают, стоит смириться с фактом присутствия нюансов работы криптовалют, в частности Биткоин. Многие и многое шлют в Россию. Telegram боты. Onion - cryptex note сервис одноразовых записок, уничтожаются после просмотра. Из минусов то, что нет пастебин внутренних обменников и возможности покупать за киви или по карте, но обменять рубли на BTC всегда можно на сторонних обменных сервисах. Немного подождав попадёте на страницу где нужно ввести проверочный код на Меге Даркнет. «Завести» его на мобильных платформах заметно сложнее, чем Onion. Биржи. Так же официальная ОМГ это очень удобно, потому что вам не нужно выходить из дома. Связь доступна только внутри сервера RuTor. Видно число проведенных сделок в профиле. Новый сервер Interlude x10 PTS - сервер со стадиями и отличным фаном на всех уровнях! Чтобы не задаваться вопросом, как пополнить баланс на Мега Даркнет, стоит завести себе криптовалютный кошелек и изучить момент пользования сервисами обмена крипты на реальные деньги и наоборот. Onion - Архив Хидденчана архив сайта hiddenchan. Underdj5ziov3ic7.onion - UnderDir, модерируемый каталог ссылок с возможностью добавления. Всегда свежая ОМГ! Если вы выполнили всё верно, то тогда у вас всё будет прекрасно работать и вам не стоит переживать за вашу анонимность. Заходите через анонимный браузер TOR с включенным VPN. В ТОР. Подборка Обменников BetaChange (Telegram) Перейти. Для регистрации нужен ключ PGP, он же поможет оставить послание без адресата. Старая. Онлайн системы платежей: Не работают! Гидра гидра ссылка hydra ссылка com гидры гидра сайт гидра зеркало зеркала гидры гидра ссылки hydra2support через гидру зеркало гидры гидра. Если вы используете импланты MegaGen AnyOne, покупайте изделия, совместимые с МегаГен. Russian Anonymous Marketplace ( ramp 2 ) один из крупнейших русскоязычных теневых форумов и анонимная торговая площадка, специализировавшаяся на продаже наркотических и психоактивных веществ в сети «даркнет». Так как на просторах интернета встречается большое количество мошенников, которые могут вам подсунуть ссылку, перейдя на которую вы можете потерять анонимность, либо личные данные, либо ещё хуже того ваши финансы, на личных счетах. Оniоn p Используйте анонимайзер Тор для ссылок онион, чтобы зайти на сайт в обычном браузере: Теневой проект по продаже нелегальной продукции и услуг стартовал задолго до закрытия аналогичного сайта Гидра. Просто покидали народ в очередной раз, кстати такая тенденция длилась больше 3 лет. Зато, в отличие от Onion, TunnelBear позволяет прикинуться пользователем другой страны и воспользоваться услугами, скажем, сервиса Netflix. Респект модераторам! Yandex проиндексировал 5 страниц.

Сайт кракен заблокирован krmp.cc - Kraken не заходит kraken ssylka onion

одим в ней файлик. Главная ссылка сайта Omgomg (работает в браузере Tor omgomgomg5j4yrr4mjdv3h5c5xfvxtqqs2in7smi65mjps7wvkmqmtqd. Иногда создаётся такое впечатление, что в мировой сети можно найти абсолютно любую информацию, как будто вся наша жизнь находится в этом интернете. Теперь покупка товара возможна за рубли. Ещё есть режим приватных чат-комнат, для входа надо переслать ссылку собеседникам. Окончательно портит общее впечатление команда сайта, которая пишет объявления всеми цветами радуги, что Вы кстати можете прекрасно заметить по скриншоту шапки сайта в начале материала. Html верстка и анализ содержания сайта. А если уж решил играть в азартные игры с государством, то вопрос твоей поимки - лишь вопрос времени. Ещё одной причиной того что, клад был не найден это люди, у которых нет забот ходят и рыщут в поисках очередного кайфа просто «на нюх если быть более точным, то они ищут клады без выданных представителем магазина координат. Onion - OstrichHunters Анонимный Bug Bounty, публикация дырявых сайтов с описанием ценности, заказать тестирование своего сайта. В Германии закрыли серверы крупнейшего в мире русскоязычного даркнет-рынка Hydra Market. Этот сервис доступен на iOS, Android, PC и Mac и работает по технологии VPN. Matanga уверенно занял свою нишу и не скоро покинет насиженное место. Это попросту не возможно. Здесь можно ознакомиться с подробной информацией, политикой конфиденциальности. Переполнена багами! Обратите внимание, года будет выпущен новый клиент Tor. Onion - Harry71, робот-проверяльщик доступности.onion-сайтов. Настоящая ссылка зеркала только одна. Минфин США ввело против него санкции. При этом на полной скорости машина может разгоняться до 350 километров в час.

Этот сайт упоминается в деловой социальной сети LinkedIn 0 раз. Данный сервер управляется панелью управления BrainyCP. На странице файлов пакета можно выбрать как официальный сайт, так и зеркало на нашем сервере. Вы используете устаревший браузер. Тем не менее, большая часть сделок происходила за пределами сайта, с использованием сообщений, не подлежащих регистрации. И постоянно предпринимают всевозможные попытки изменить ситуацию. Onion - Freedom Image Hosting, хостинг картинок. Программа является портабельной и после распаковки может быть перемещена. Как зайти на onion сайт Так как открыть онион сайты в обычном браузере не получится, то для доступа к ним необходимо загрузить на компьютер или мобильное устройство Tor Browser. Первый способ попасть на тёмную сторону всемирной паутины использовать Тор браузер. Многие из них не так эффективны, как хотелось. Гидра правильная ссылка. На самом деле это сделать очень просто. Именно по этому мы будет говорить о торговых сайтах, которые находятся в TOR сети и не подвластны блокировкам. Onion - Bitmessage Mail Gateway сервис позволяет законнектить Bitmessage с электронной почтой, можно писать на емайлы или на битмесседж protonirockerxow. После этого отзывы на russian anonymous marketplace стали слегка пугающими, так как развелось одно кидало и вышло много не красивых статей про админа, который начал активно кидать из за своей жадности. Ещё одной причиной того что, клад был не найден это люди, у которых нет забот ходят и рыщут в поисках очередного кайфа просто «на нюх если быть более точным, то они ищут клады без выданных представителем магазина координат. Наконец-то нашёл официальную страничку Mega. Это не полный список кидал! Заблокирован материал и комментарии. В расследовании, выпущенном журналистами «Ленты было рассказано, что на уничтожение ramp в известной степени повлияли администраторы Hydra. Если подробно так как Гидра является маркетплейсом, по сути сборником магазинов и продавцов, товары предлагаемые там являются тематическими. Кто чем вместо теперь пользуется? Список ссылок обновляется раз в 24 часа. Для этого используют специальные PGP-ключи. Тороговая площадка! Анонимность Мега сайт создан так, что идентифицировать пользователя технически нереально. Третьи продавцы могут продавать цифровые товары, такие как информация, данные, базы данных. Отключив серверы маркета, немецкие силовики также изъяли и крупную сумму в криптовалюте. Как выглядит рабочий сайт Mega Market Onion. Финансы. Частично хакнута, поосторожней. Еще один способ оплаты при помощи баланса смартфона. GoosO_o Сегодня Норма VladiminaTOR Вчера Мега супер, сегодня с парнями скинулись на стафчик и взяли сразу побольше, спасибо за зеркала! Логин не показывается в аккаунте, что исключает вероятность брутфорса учетной записи. На самом деле в интернете, как в тёмном, так и в светлом каждый день появляются сотни тысяч так называемых «зеркал» для всевозможных сайтов. Одним из самых простых способов войти в Мегу это использовать браузер Тор. Робот? По типу (навигация. Пока пополнение картами и другими привычными всеми способами пополнения не работают, стоит смириться с фактом присутствия нюансов работы криптовалют, в частности Биткоин. В этой Википедии вы найдете все необходимые вам ссылки для доступа к необходимым вам, заблокированным или запрещённым сайтам. Onion - Sci-Hub,.onion-зеркало архива научных публикаций (я лично ничего не нашёл, может плохо искал). О готовности заменить (или подменить) «Гидру» заявили семь-восемь серьезных площадок.