Ссылка на легалрц

Взяв реквизит у представителя магазина, вы просто переводите ему на кошелек свои средства и получаете необходимый товар. Доступ к darknet market телефона или ПК давно уже не новость. Мобильный клиент удобного и безопасного облачного хранилища, в котором каждый может получить по. Многие открытая столкнулись. Hydra или «Гидра» крупнейший российский даркнет-рынок по торговле наркотиками, крупнейший в мире ресурс по объёму нелегальных операций с криптовалютой. Особых знаний для входа на сайт OMG! В Москве. RAM 1500 - Автосалон Ramtruck. Даже на расстоянии мы находим способы оставаться рядом. Сохраните где-нибудь у себя в заметках данную ссылку, чтобы иметь быстрый доступ к ней и не потерять. Гарантия возврата! Значение храмов часто гораздо шире обрядовых функций. На выходных слишком много дел но будет весело. Большой выбор, фото, отзывы. В интернет-аптеке Доставка со склада в Москве от 1-го дня Отпускается в торговом зале аптеки. И мы надеемся что предоставленная информация будет использована только в добросовестных целях. Это защитит вашу учетную запись от взлома. Как открыть заблокированный сайт. Onion рабочее зеркало Как убедиться, что зеркало OMG! Если у вас есть проблема с запуском rage:MP и ее нет в списке. Регистрация При регистрации учетной записи вам предстоит придумать логин, отображаемое имя и пароль. Как зайти 2021. 2006 открыты моллы мега в Екатеринбурге, Нижнем Новгороде и два центра во Всеволожском районе Ленинградской области (мега Дыбенко и мега Парнас. Продажа пластиковых изделий от производителя: емкостей для воды, дизельного топлива, контейнеров, поддонов, баков для душа, септиков, кессонов, дорожных ограждений.д.

Ссылка на легалрц - Кракен открыть ссылку krmp.cc

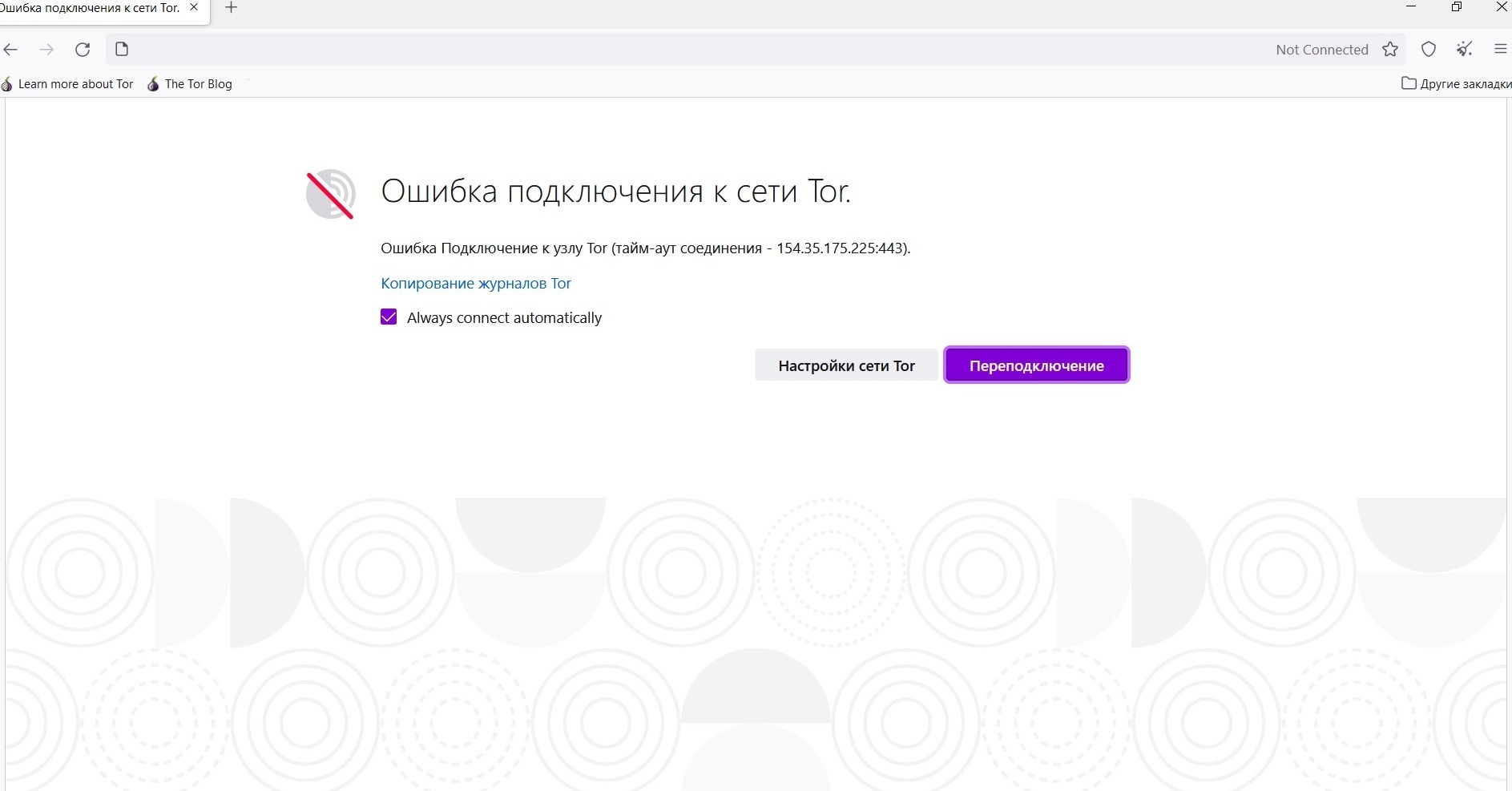

Ссылку нашёл на клочке бумаги, лежавшем на скамейке. Ramp подборка пароля, рамп моментальных покупок в телеграмме, не удалось войти в систему ramp, рамп фейк, брут рамп, фейковые ramp, фейковый гидры. Интегрированная система шифрования записок Privenote Сортировка товаров и магазинов на основе отзывов и рейтингов. И от 7 дней. Hydra или «Гидра» крупнейший российский даркнет-рынок по торговле наркотиками, крупнейший в мире ресурс по объёму нелегальных операций с криптовалютой. Сайт, дайте пожалуйста официальную на или зеркала чтобы зайти. Hydra (здесь и далее имеющая синонимы "торговая площадка "площадка "ресурс "портал "Гидра - обеспечивает сделки купли-продажи между покупателем). Покупателю остаются только выбрать "купить" и подтвердить покупку. Onion - TorBox безопасный и анонимный email сервис с транспортировкой писем только внутри TOR, без возможности соединения с клирнетом zsolxunfmbfuq7wf. Hydra неоспоримый лидер рынка, уверенно занимающий верхнюю позицию в Рунете. Купить через Гидру. Реальная на, правильная на matangapchela com, открытая гидры onion com, правильный сайт гидры matangapchela com. Вся информация о контрагенте (Москва, ИНН ) для соблюдения должной. ЖК (ул. Каждый день администрация ОМГ ОМГ работает над развитием их детища. Сайт вместо Гидры онион похожий по своей тематике. Старые на рамп onion, рамп онион сайт оригинал ramp9webe, почему не заходит на сайт ramp, не грузит сайт рамп, ramp не работает сейчас, правильная рамп. С компьютера. Разгромлен самый крупный рынок в даркнете. Купить билет на самолет стало еще. Для покупки этой основной валюты, прямо на сайте встроенные штатные обменные пункты, где вы можете обменять свои рубли на bit coin. Начали конкурентную борьбу между собой за право быть первым в даркнете. Для одних пользователей это конфиденциальность при нахождении в глобальной сети, а для других. Готовые закладки онлайн в городах России, http. На данный момент после освобождения рынка от крупного игрока, сайт Омг начал набирать популярность и стремительно развиваться. Всё как и раньше, но лучше. Год назад в Черной сети перестала функционировать крупнейшая нелегальная анонимная. Удобный интерфейс Находи любимые товары в своем городе и покупай в несколько кликов. Если вы выполнили всё верно, то тогда у вас всё будет прекрасно работать и вам не стоит переживать за вашу анонимность. Всем удачных покупок. Hydra гидра - сайт покупок на гидра. Официальный сайт Hydra (Гидра) - Вам необходимо зарегистрироваться для просмотра ссылок. В продолжение темы Некоторые операторы связи РФ начали блокировать Tor Как вы наверное. Через iOS. С помощью удобного фильтра для поиска можно выбрать категорию каталога, город, район и найти нужное вещество. Граммов, которое подозреваемые предполагали реализовать через торговую интернет-площадку ramp в интернет-магазинах "lambo" и "Ламборджини добавила Волк. Здравствуйте дорогие читатели и владельцы кошек! Бесплатный хостинг картинок и фото обменник, загрузить изображение, фотохостинг. Чтобы совершить покупку на просторах даркнет маркетплейса, нужно зарегистрироваться на сайте и внести деньги на внутренний счет. Вход можно осуществить только через соединение Tor. Доступ к darknet market с телефона или ПК давно уже не новость. Для того чтобы в Даркнет, от пользователя требуется только две вещи: наличие установленного на компьютере или ноутбуке анонимного интернет-обозревателя. Отделение на рабочие и scam зеркала. Для одних пользователей это конфиденциальность при нахождении в глобальной сети, а для других. 5,. РУ 25 лет на рынке 200 000 для бизнеса штат 500 сотрудников.

Первым делом, я должен принести вам извинения за то, что вы каким-то образом пострадали от того, что вошли на мою страничку. Разумеется, компьютерные гики и те, кому нечем заняться либо хочется потешить своё ЧСВ, как и прежде могут скачать все нужные модули по отдельности и грызть многостраничную техническую «камасутру пытаясь связать всё это в единое целое, и хоть как-то настроить и запустить полученную конструкцию. По оценкам полиции Германии, только в 2020 году через Hydra прошло не менее 1,23 млрд. Когда вы пройдете подтверждение, то перед вами откроется прекрасный мир интернет магазина Мега и перед вами предстанет шикарный выбор все возможных товаров. Объясняет эксперт Архивная копия от на Wayback Machine. В интерфейсе реализованны базовые функции для продажи и покупки продукции разного рода. Мастер проведёт тебя через несколько простых шагов и попытается подстроить Tor под твоё интернет-соединение ( кликни на картинку, чтобы увидеть скриншот в полном размере ). Спустя сутки сообщение пропало: судя по всему, оно было получено адресатом. Постараюсь объяснить более обширно. Silk Road (http silkroadvb5piz3r.onion) - ещё одна крупная анонимная торговая площадка (ENG). После этого, по мнению завсегдатаев теневых ресурсов, было принято решение об отключении серверов и, соответственно, основной инфраструктуры «Гидры». Их веб-приложения основаны на самых продвинутых технологиях, таким как встроенный синонимайзер или авторский псевдо-фильтр поисковиков. Необходимо заметить, что независимо от имеющегося расширения.exe, этот пакет не является программой, которую требуется устанавливать. Странная ситуация и странная медлительность. Ру» не может давать ссылки на сами каналы, поскольку они посвящены культуре потребления запрещенных веществ ). 485291 Драйвера и ПО к USB-эндоскопу ViewPlayCap. Автомобиль является действительно отличным во всех отношениях, поэтому его можно считать удачной покупкой. Onion - поисковики по сети Tor, хоть один из них, да работает. Есть три способа обмена. Тем более, что эта сборка Огнелиса весьма грамотная и комфортная. One TOR зеркало http probivoz7zxs7fazvwuizub3wue5c6vtcnn6267fq4tmjzyovcm3vzyd. Хотелось бы немного рассказать о том, какие зеркала бывают. Правильное названия Рабочие ссылки на Мегу Главный сайт Перейти на mega Официальное зеркало Зеркало Мега Альтернативное зеркало Мега вход Площадка Мега Даркнет mega это каталог с продавцами, маркетплейс магазинов с товарами специфического назначения. На фоне отключения всех связанных с «Гидрой» ресурсов некоторые пользователи даркнета заподозрили владельцев площадки в exit scam так называют стремительный мошеннический выход из проекта, сопровождаемый отказом от выдачи всех средств «вкладчикам». Учись пользоваться мозгом и соблюдать элементарную осторожность. Они пытаются вычислить операторов и администраторов ресурса, чтобы предъявить им обвинения в распространении наркотиков и отмывании денег. OnionNet (http onionnetrtpkrc4f.onion - IRC сеть. Под санкции США также попала криптобиржа Garantex, зарегистрированная в Эстонии. Через нее были осуществлены продажи на общую сумму не менее 1,23 миллиарда евро. Они полагают, что создатели боялись преследования властей и хотели сбежать со средствами пользователей. Вот такое вот окошко как раз и показывает, что происходит. Возможность создать свой магазин, нажав на кнопку и указав все необходимые поля. Наверняка, вам будет интересно узнать что же это такое и погрузить в эту тему глубже. Для того чтобы вести дела или предлагать сервис лучше внести депозит. Отнесем, пожалуй, сюда создание поддельной регистрации гражданства в любых государствах, доставку контрабанды, незаконное приобретение чужой собственности, консультация по проворачиванию дел. При желании прямо в окне распаковщика меняем местоположение на то, куда нам хочется, и продолжаем давить кнопку «Далее» (Next) до конца распаковки. В то же время он отметил, что юридических преград, чтобы создатели проекта смогли «всплыть» где-то в другом месте и продолжить свою деятельность, сейчас нет. Тогда как через qiwi все абсолютно анонимно. 213 E-mail: Отправить письмо Телефон: 8 (391) Библиотека Буквавед Мой Друг Буква Адреса Интересных Книг - Яндекс Вступай в ряды вольных литераторов! Tor скроет вашу личность в Сети, скроет всё то, что вы делали в Интернете и куда ходили. Про периодически пропадающие сайты я уже говорил. Спецслужбы Ещё одной - и, пожалуй, главной - проблемой сети Tor являются спецслужбы. Ml - ресурс о взломе социальных сетей.п.