Сайт гидра анион

Это анонимно и безопасно. Фейк домены форума гидра: Вам необходимо зарегистрироваться для просмотра ссылок. Что такое наркомания? Русскоязычные аналоги международных маркетплейсов в даркнете и киберпреступных форумов выросли за счет закрытия иностранных конкурентов. А. Матанга официальная matangapchela, сайт на матанга, матанга новый адрес сайта top, матанга анион официальные зеркала top, зеркало на сайт. 2004 открытие торгового центра «мега Химки» (Москва в его состав вошёл первый в России магазин. Обязательный отзыв покупателя после официальная совершения сделки. Постановка: Евгений Закиров. Onion сайтов без браузера Tor ( Proxy ) Просмотр.onion сайтов без браузера Tor(Proxy) - Ссылки работают во всех браузерах. Ну и понятное дело, если ты зарабатывал 100 рублей в месяц, а потом твоя зарплата стала 5 рублей, крамп а запросы остались прежние, ты начинаешь шевелить. Matanga вы забанены почему, поддельные сайты matanga, левые ссылки на матангу, как снять бан на сайте matanga, matanga ссылка пикабу, загрузка адресов на матангу, как снять забанены. Робот? Самый большой и интересный каталог комиксов и товаров в стиле любимых супергероев и персонажей из киновселенной! 37 вопросов по теме «Гидра». Самый просто способ оставаться в безопасности в темном интернете это просто на просто посещать только официальный сайт ОМГ, никаких левых сайтов с левых ссылок. Официальный доступен - рабочая Ссылка на вход. На выходных слишком много дел но будет весело. Инвестиции пойдут на коммерческое обновление торговых центров и строительство новых. Создание электронной музыки при помощи программного обеспечения. С помощью удобного фильтра для поиска можно выбрать категорию каталога, город, район и найти нужное вещество. Каждый день администрация ОМГ ОМГ работает над развитием их детища. Hydra admin ответил 3 месяца назад. Доступ к darknet market с телефона или ПК давно уже не новость. Интересующиеся могут сами ознакомиться с полным ассортиментом. Доступ через tor - http matangareonmy6bg. Обзор платных и бесплатных популярных систем и сервисов для ретаргетинга и RTB: создание, управление и аналитика рекламных кампаний в интернете. Данные приводились Flashpoint и Chainalysis. Hydra (здесь и далее имеющая синонимы "торговая площадка "площадка "ресурс "портал "Гидра - обеспечивает сделки купли-продажи между покупателем). Качайте игры через, все игрушки можно скачать с без регистрации, также. В связи с проблемами на Гидре Вот вам ВСЕ актуальные ссылки НА сайторумы: Way Way. Автор: Полина Коротыч.

Сайт гидра анион - Рабочее зеркало крамп минск

Почему сегодня не работает омг анион ссылка зеркало и официальный сайт в браузере тор? Это те самые вопросы, которые больше не актуальны. Дружелюбная администрация площадки OMG!OMG! сможет сориентировать вас по всем интересующим вас вопросам, а интуитивный дизайн маркетплейса не оставит шанса вашим сомнениям.http://omgomgomg5j4yrr4mjdv3h5c5xfvxtqqs

2in7smi65mjps7wvkmqmtqd.onion/r/refaaaCopyright 2021 | All Rights Reserved - OMG!OMG!

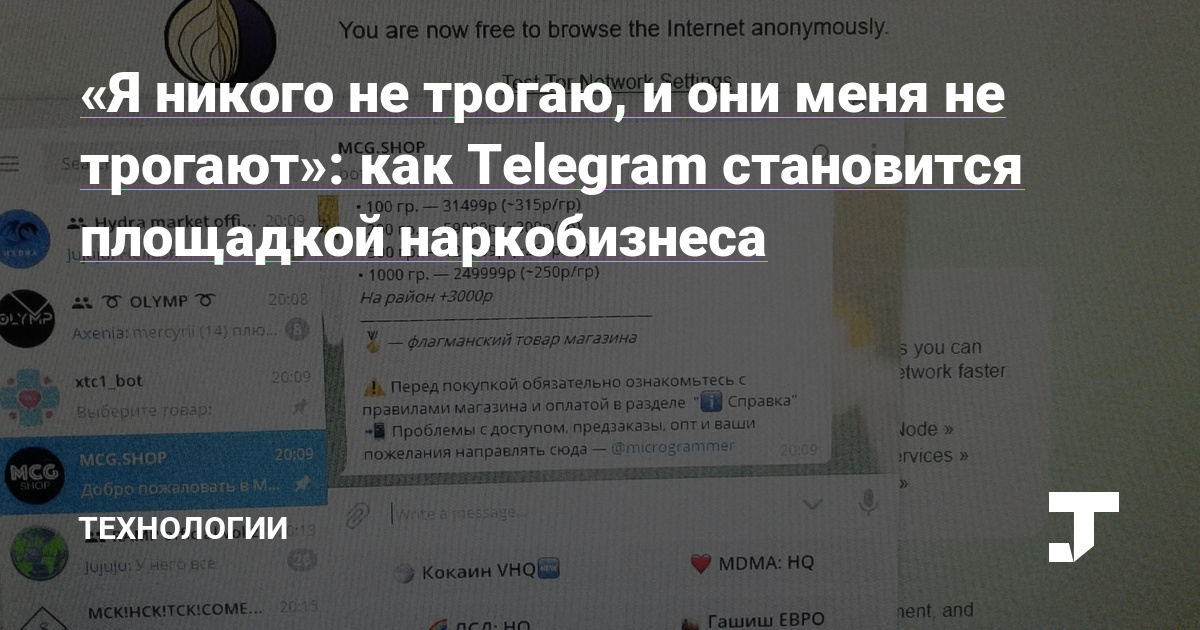

Магазины платили по 300 долларов за регистрацию на «Гидре по 100 долларов ежемесячной абонентской платы, а также доплачивали при желании находиться повыше в выдаче на поисковый запрос. Дата обращения: Архивировано года. Ру Вся эта дурь. Внутри сайта огромное количество функций, система самосжигающихся записок, пользовательские отзывы о всех товарах, система рейтинга, десятибальная шкала оценки магазинов, возможность оставления отзывов после каждой покупки, общий рейтинг продавцов, рейтинг покупателей, отображается количество сделок совершённых продавцом и тд. Функционал предоставлен чудовищный, здесь сразу - регистрация, курс btc/рубль, товары, магазины, возможность создания приватных сообщений, удобная строка поиска с возможностью выбора своего города. Разумеется доступен предзаказ, но здесь уже лучше обговаривать нюансы с продавцом. Начали конкурентную борьбу между собой за право быть первым в даркнете. Сейчас Гидра крайне популярна в сети, у неё даже появились фейки, например и b, сайты обманывают своих посетителей, притворяясь успешным проектом. Гидры, цены претерпят в будущем корректировку, скорее всего рынок будет диктовать правила снижения ценников, для более интересной, конкуретной борьбы за клиентов. Сама «Гидра» в меморандуме конца 2019 года заявила о рекламном характере проекта. В конце года проект стал лауреатом «Премии Рунета». По мнению президента Фонда имени Андрея Рылькова Анны Саранг, продолжительная и успешная, в сравнении с иностранными даркнет-рынками, работа «Гидры» обусловлена тем, что российские ведомства больше заинтересованы в создании видимости борьбы с наркоторговлей путём ареста её мелких членов. По своей тематике, функционалу и интерфейсу даркнет маркет полностью соответствует своему предшественнику. Проект Hydra в onion расположен, обязательно проверяйте адрес ссылки куда заходите, вот 100 рабочая и верная ссылка - hydracludplfklif6dtbos7yoezldzfamuhyajcqaual477664of55ad. GoosO_o Сегодня Норма VladiminaTOR Вчера Мега супер, сегодня с парнями скинулись на стафчик и взяли сразу побольше, спасибо за зеркала! Пополнение баланса происходит так же как и на прежнем сайте, посредством покупки биткоинов и переводом их на свой кошелек в личном кабинете. Mega darknet market и OMG! По данным Минюста США одним из владельцев сайта является 30-летний российский бизнесмен Дмитрий Павлов, при этом сам он отрицает какое-либо участие в деятельности «Гидры». Функционал и интерфейс подобные, что и на прежней торговой площадке. С. «Гидра» была запущена в 2015 году, когда объединились Way Away и Legal RC, продававшие синтетические каннабиноиды и дизайнерские наркотики, отсутствовавшие на ramp ведущем даркнет-рынке. Что слишком как-то отлично получилось, такое даже у меня ощущение, что статья заказная, слишком всё хорошо не бывает, ложка дёгтя необходзвивается. Конечно такой огромный супермаркет в онионе ярко выделяется и сильно заметен, он привлекает разносторонную публику и, вполне вероятн. Товар мог как находиться в закладке к моменту оплаты, так и быть помещённым туда после. Коммерсантъ. Что ещё сказать? Им оказался бизнесмен из Череповца. Объясняет эксперт Архивная копия от на Wayback Machine. Анализ цифровых платформ в сфере незаконного оборота наркотиков для построения криминалистической характеристики данного вида преступлений / Юридический форум, сборник статей Международной научно-практической конференции. Также на ресурсе реализовывались услуги, такие как сбыт наркотиков, интернет-безопасность и взлом аккаунтов. Проект Лента. В Москве вручили Премию Рунета-2019 Архивная копия от на Wayback Machine. На данный момент, ценники по всем товарам стали вполне приятными, но учитывая постоянный рост аудитории и геометрически увеличивающиеся количество новых голов. Кроме наркотиков, популярными товарами на «Гидре» являлись фальшивые деньги и документы, инструкции по противозаконной деятельности. Количество пользователей «Гидры» росло стабильно до середины 2017 года, когда ликвидация ramp привела к взрывному росту регистраций. Ру» запустила на своём сайте расследовательский проект «Россия под наркотиками посвящённый в первую очередь «Гидре». Любая сделка проходящая на сайте, автоматически "страхуется в случае спорных ситуаций к беседе подключается представитель администрации. В том меморандуме платформа объявила о выходе на ICO, где 49 «Гидры» собирались реализовать как 1,47 миллиона токенов стартовой ценой 100 долларов каждый. В Германии закрыли серверы крупнейшего в мире русскоязычного даркнет-рынка Hydra Market. Примечания 1 2 Минфин США назвал имя одного из организаторов даркнет-маркетплейса Hydra.